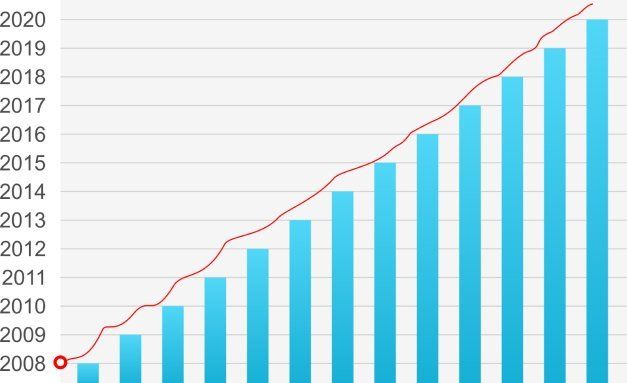

Total Credit Card Debt is now $1 Trillion

Consumers who join Start New Financial’s debt relief program on average have $30,000 in credit card debt. We pay upfront for referring consumers to our program and provide lead programs.

Due to the COVID-19 pandemic, debt has increased in the US, where more than half (51%) of credit card holders have consequently increased their credit balance.

Capitalize in our industry on the economic damage the pandemic has wrought, that increased consumer debt and decreased jobs and income.

Competitive Debt Relief programs in the market have poor customer service, high cancellation and charge off-rates.

How Our Customers Feel About Our Services

Other Debt Relief

Backends

❌ At best, they pay up to 1% of the debt upfront or nothing upfront

❌ Provide no lead system

❌ Provide blocky CRM or no CRM at all

❌ Provide no training program or poor training program at best

❌ Have a high customer cancellation rate

❌ Have poor reviews

✅ The highest commission payout in the industry

✅ Provides a lead program to match your needs

✅ Has an easy to use CRM, learn it in an hour with video training provided

✅ Consistent training

✅ Lowest cancellation rate in the industry

✅ Excellent reviews and A+ rating with the BBB

Get a Free Debt Assessment

Simply fill out the form and one of our debt resolution experts will contact you. Soon, you’ll be on your way to a debt-free life!